The information you need to make your sustainability ambitions a reality

In this edition

- IPCC climate change report rings the alarm for humanity

- UK government launches plan for a world-leading hydrogen economy

- Event: The 2nd Annual CIBC Sustainability Conference: The Road to COP26

- Podcast: Governance – The rise of the activist investor

CIBC declares net zero ambition by 2050, increases sustainable finance target

CIBC announced its ambition to achieve net zero greenhouse gas emissions associated with operational and financing activities by 2050, and a significant increase in its commitment to mobilizing sustainable finance to a target of $300 billion by 2030, driven by a strong positive response from clients and a growing opportunity in the market to further invest in their sustainability initiatives.

To help achieve its net zero ambition, the bank is establishing key areas of focus, including leading our clients through the transition to a lower carbon economy; refining our operations; encouraging consumer behaviors that reduce climate impact; and sharing our progress with stakeholders.

Aligned to these areas of focus, CIBC will be setting interim targets for financed emission reduction, with reporting on key sectors beginning in fiscal 2022. In addition, CIBC will achieve carbon neutrality in its operations as of the end of 2024, including sourcing 100% of electricity for operations from renewable sources. CIBC will also encourage consumer behaviour through a Climate Ambition Hub coming soon to our website that will provide education, resources and advice to help clients reduce their environmental impact.

Achieving net zero ambitions by 2050 – Key pillars of change

Corporations, governments and other institutions are making net zero pledges almost daily. A University of Princeton study goes a step further to outline the actions needed to translate these pledges to real progress in order to achieve net zero ambitions. The report highlights that a net-zero America by 2050 is possible by focusing on six pillars of change which include: the improvement of end-use energy efficient and electrification; the deployment of clean electricity; use of bioenergy and other zero carbon fuels and feedstocks; CO2 capture, transport, usage, and geologic storage; a reduction of non- CO2 emissions like methane and nitrous oxides; and enhanced land sinks.

Institutions that have made net zero pledges should begin to implement plans to achieve their goals and we recommend this report as a helpful resource.

IPCC climate change report rings the alarm for humanity

The Intergovernmental Panel on Climate Change (IPCC) recently issued its sixth assessment report, Climate Change 2021: The Physical Science Basis. The report warns the world of increasing global warming, heatwaves, flooding and other weather extremes, unless deep reductions in CO2 and other greenhouse gas (GHG) emissions are made.

A few key takeaways of the report:

- Human influence “unequivocally” has warmed the atmosphere, ocean and land: global surface temperature was 1.1°C higher in the decade commencing 2011 than it was between 1850–1900, and the past 5 years have been the hottest on record since 1850, with larger increases over land (1.6°C) than over the ocean (0.9°C). A reminder that 1.5 degrees is locked in and is our best case scenario – weather patterns will only be worse from here onwards including oceans, ice sheets and global sea levels.

- Land and ocean have taken up about 56% per year of CO2 emissions over the past six decades; however, the proportion decreases with increasing cumulative CO2 emissions. Hence, the need to protect our carbon sinks.

According to the report, human actions still have the potential to determine the future course of climate change, and will form a basis for policy leaders’ negotiations at the COP26 Global Climate Summit in November.

Methane emissions – A growing concern

Much has been said about the need for massive cuts in carbon dioxide emissions, however, focusing on reducing emissions of methane may be one of the fastest and most effective steps to slow global warming in the short term.

Methane is a much more powerful global warming gas than carbon dioxide, but it stays in the atmosphere for only about a decade compared to more than a century for carbon. This presents a unique opportunity to cut greenhouse gas emissions quickly over the next few decades if more focus is placed on reducing methane emissions. The oil and gas sectors can help to reduce methane emissions simply by eliminating methane leaks from wells and pipelines. Expect to see additional government focus and investor scrutiny on methane emissions over time.

Early corporate offset purchase – Lessons from Microsoft

Microsoft recently released its lessons from an early corporate purchase which describes the tech giant’s efforts for carbon removal. The report notes that although deep carbon reduction is the company’s top priority, physically removing carbon from the atmosphere will also be essential to their ability to meet net-negative target scale and timeframe. The Microsoft report commendably describes what makes an attractive offset and also speaks to the company’s request for proposal process.

A handful of other organizations are also incorporating carbon removal into their climate strategies, including Amazon, Apple, BCG, Delta, Facebook, Google, Mars, Shopify, Stripe, SwissRe, United and Velux.

UK government launches plan for a world-leading hydrogen economy

On August 17, 2021 the UK government introduced its proposed vision to kick start a world-leading hydrogen (“h2”) economy set to support over 9,000 UK jobs and unlock £4bn investment by 2030.

The UK’s first-ever hydrogen strategy drives forward the commitments, laid out in the 10-Point Plan for a green industrial revolution, by setting the foundation for how the UK government will work with industry to meet its target of 5GW of low carbon hydrogen production capacity by 2030. To aid polluting industries to significantly slash their emissions, the government also announced a £105m funding package, through its Net Zero Innovation Portfolio, that will act as a first step to build up Britain’s low carbon hydrogen economy. The investment will help industries to develop low carbon alternatives for industrial fuels, including hydrogen, which will be key to meeting climate commitments. In light of the Government’s twin track approach across blue and green H2, the Chair of the UK Hydrogen & Fuel Cell Association (HFCA), Chris Jackson, recently resigned claiming blue hydrogen production will subsidize the fossil fuel industry into the future and will prevent the UK meeting its climate change targets.

ESG disclosure ramps up in China

China has made news about a regulatory crackdown on its tech and education businesses. Lost in a lot of this noise was new information on disclosure rules relating to annual reports and to half-year reports for listed companies in China. This was the first update since 2017 and mandates that all listed companies are now required to disclose in their annual reports any administrative penalties relating to environmental issues received during the reporting period.

The “Key Polluting Entities” are however under more stringent disclosure obligations. For clarity, these entities/industries include oil processing, nuclear fuel, chemicals and chemical products, metals, pharm chemicals; chemical fabrics production; metals & rolling processing; textiles, and new coal chemical industries. These key polluting entities will be obliged to disclose such information as its pollution, its prevention controls, environmental impacts, and other relevant information.

Private equity receives ESG roadmap

The Institutional Limited Partners Association (ILPA) recently published an ESG Roadmap to assist limited partners in implementing ESG efforts across Limited Partner (LP) organizations. The roadmap is meant to be dynamic and the ILPA encourages submissions to help refine best practices.

ESG-anchored remuneration on the rise in Europe

As ESG continues to reshape finance, remuneration may now be tied to contributing to a cleaner environment, a better society and good governance.

According to a recent Bloomberg survey of twenty (20) major European banks, it was found that the financial institutions were either working on, or already had, a model that links staff remuneration to a firm’s performance on sustainability metrics. Although measuring sustainability is far from straightforward, the ultimate goal, ideally, is to make it financially attractive to be good.

Sustainability across CIBC

At CIBC, we are committed to making sustainability a reality for our clients and the communities we serve. We have built a market-leading Renewables franchise to provide our clients with expert advice, capital and access to capital markets in this important sector. Whether through greening your balance sheet or providing sustainability advisory services, our objective is to help our clients become global leaders in environmental stewardship and sustainability.

CIBC events

Upcoming event

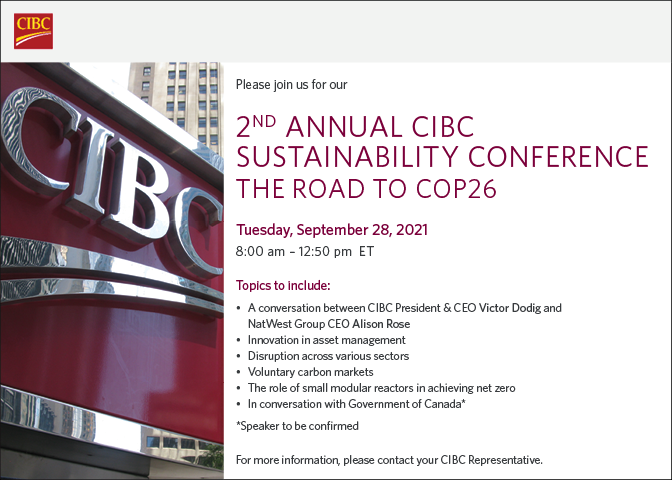

2nd Annual CIBC Sustainability Conference: The Road to COP26

Tuesday, September 28, 2021

8:00 am – 12:45 pm ET

Publications

‘The Sustainability Agenda’ – Podcast Series

CIBC Capital Markets’ latest podcast series focusing on the evolving complexities of the sustainability landscape – with a view on addressing current issues in a concise format to help you navigate and take action.

Did you know?

![]()

![]() The average person emits around 16.2 metric tons of CO2 from fossil fuels each year. To offset that, they would have to plant around 8-10 trees per year.

The average person emits around 16.2 metric tons of CO2 from fossil fuels each year. To offset that, they would have to plant around 8-10 trees per year.

Source: One Tree Planted

CIBC Capital Markets Insight Portal

Your one-stop destination for thoughtful and timely insights on today’s most critical issues cibccm.com/en/insights

Stay informed. Follow CIBC Capital Markets on LinkedIn.

The CIBC logo and “CIBC Capital Markets” are trademarks of CIBC, used under license.